Commercial Banks Functions

Functions of commercial banks.

Commercial banks functions. Collecting bills draft cheques etc. However besides these functions there are many other functions which these banks perform. Paying the insurance premium rent loan installments etc. The deposits may be of three types.

The nature of banks has changed as time has changed. Credit creation is one of the most important functions of the commercial banks. Secondary functions of commercial banks. Commercial bank function 3.

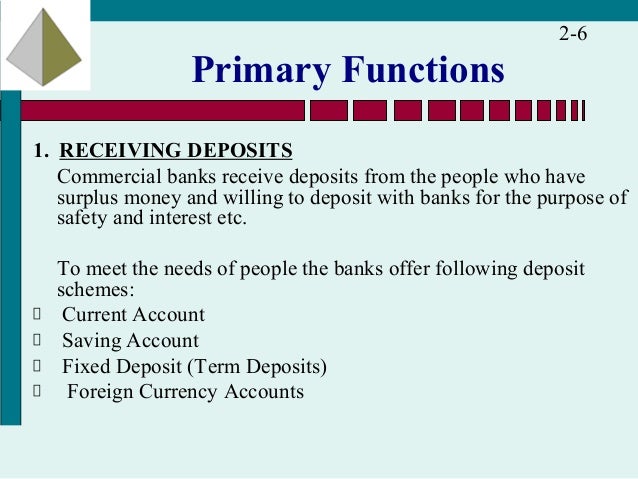

A primary functions accepts deposit the bank takes deposits in the form of saving current and fixed deposits. Banks have developed around 200 years ago. When the bill matures the bank gets payment from the banker. Commercial banks provide facility of safety vaults or lockers to keep valuable articles of customers in safe custody.

All these functions can be divided under the following heads. A bank acts as an agent to its customers for various services like. Commercial banking is the most significant portion of modern banking system. In order to earn profit the bank accept deposits and advance loans by keeping a small cash in reserve to meet the day to day needs of the customers.

In case of current account people can withdraw deposits in part or in full at any time he likes without notice. The main functions of commercial banks are accepting deposits from the public and advancing them loans. Commercial banks are institutions that conduct business for profit motive by accepting public deposits for various investment purposes. The most important functions of commercial banks are discussed below.

The secondary functions of a commercial bank are as follows. The most significant and traditional function of commercial bank is accepting deposits from the public. Functions of commercial bank primary functions accepting deposits. The primary function for which the commercial banks were established is to accept deposits from the general public who possess surplus funds and are willing to deposit them so as to earn interest on it.

Saving deposits current deposits and fixed deposits. Functions of a commercial bank include receiving deposits disbursing payments collections safeguarding money loaning money and maintaining and servicing checking savings and custodial. Iii letter of credit. Commercial banks issue travelers cheques to their customers to avoid risk of taking cash during their journey.

Bank as an agent.